Authors: Jessie Press-Williams, Priscilla Negreiros, Pedro de Aragão Fernandes, Chavi Meattle, Hamza Abdullah, Arthur Vieira, Jose Diaz, Ben Melling.

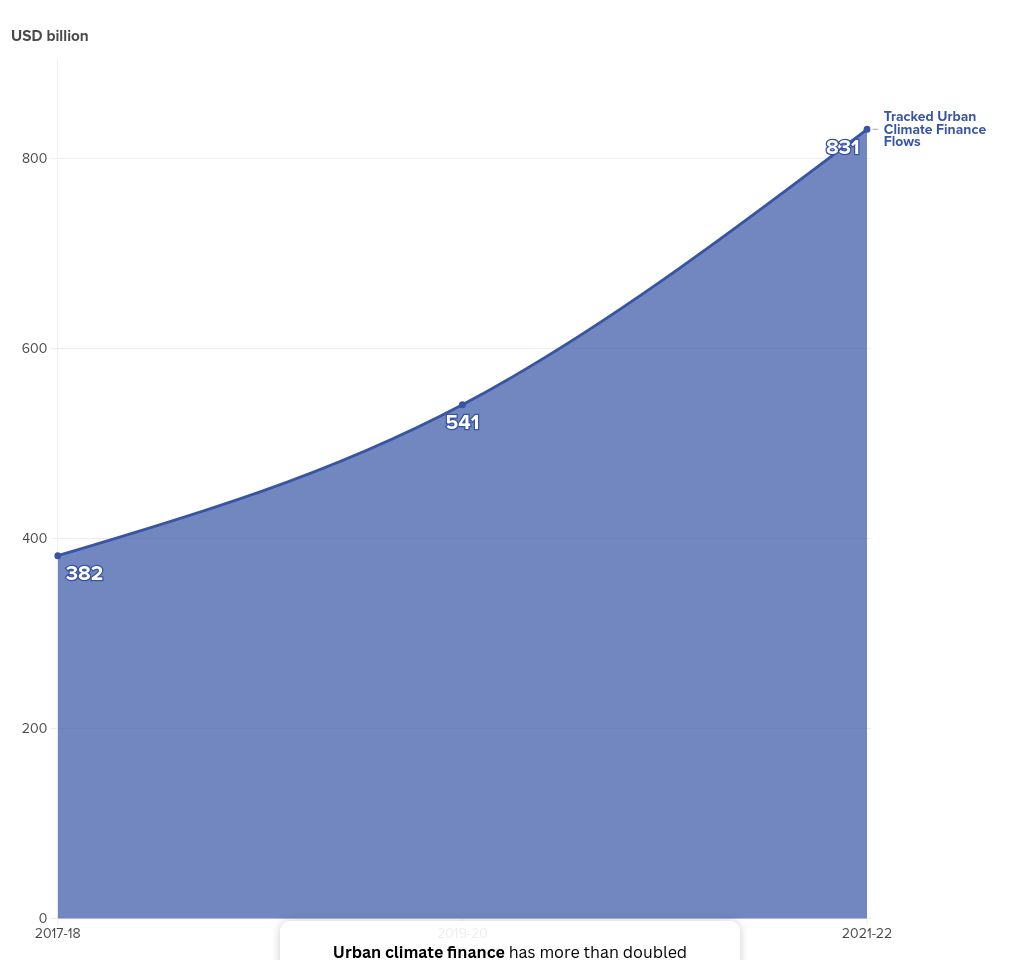

The 2024 State of Cities Climate Finance Report (SCCFR) provides a comprehensive assessment of global urban climate flows and needs. It aims to introduce measures to raise funds for climate action at the city level by 2030.

Cities are the most important actors in climate change. Currently, 56% of the world’s population lives in cities and 70% of people are expected to live in urban areas by 2050 (World Bank 2023a). Many urban areas, especially in emerging markets and developing economies (EMDEs), are already facing extreme and extreme weather events such as floods, droughts and heat waves.

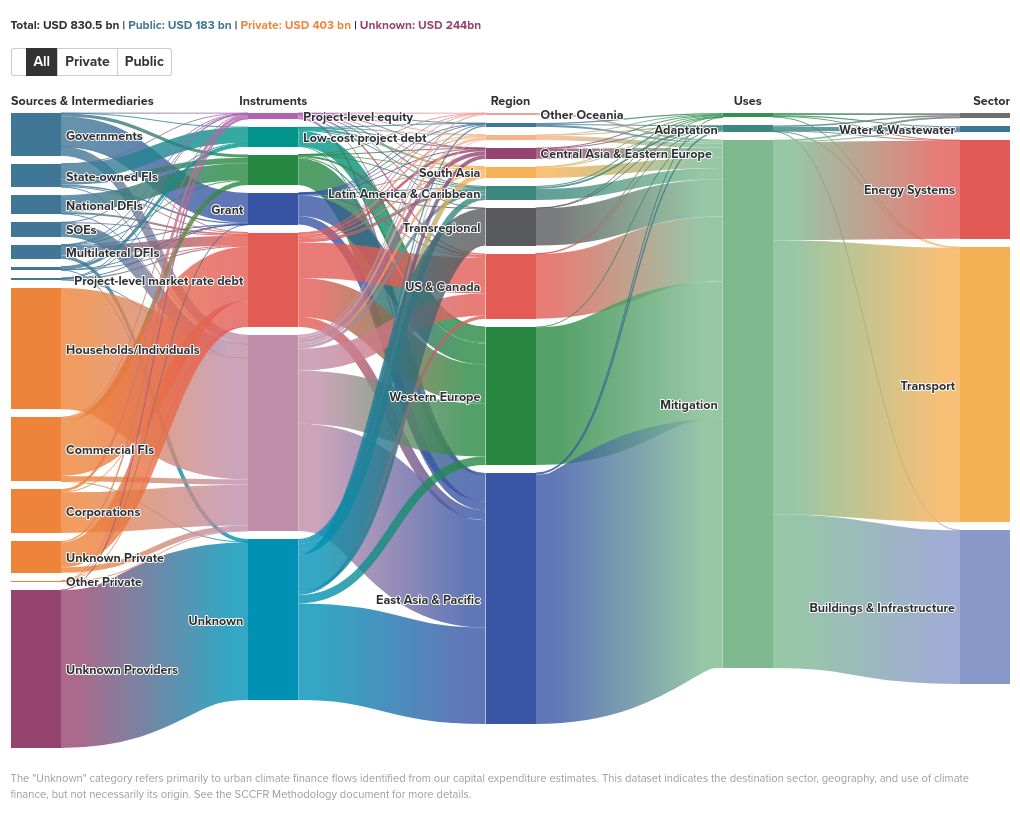

The majority of urban climate finance (69%) was locally sourced and providedand this trend is likely to grow. This is especially true for private flows, where local sources were 96%.

Sub-Saharan Africa was the only region where the majority of funding came from international sources (69%).

Urban climate finance from developed to developing countries totals only $12 billion (

Explore more urban climate funds:

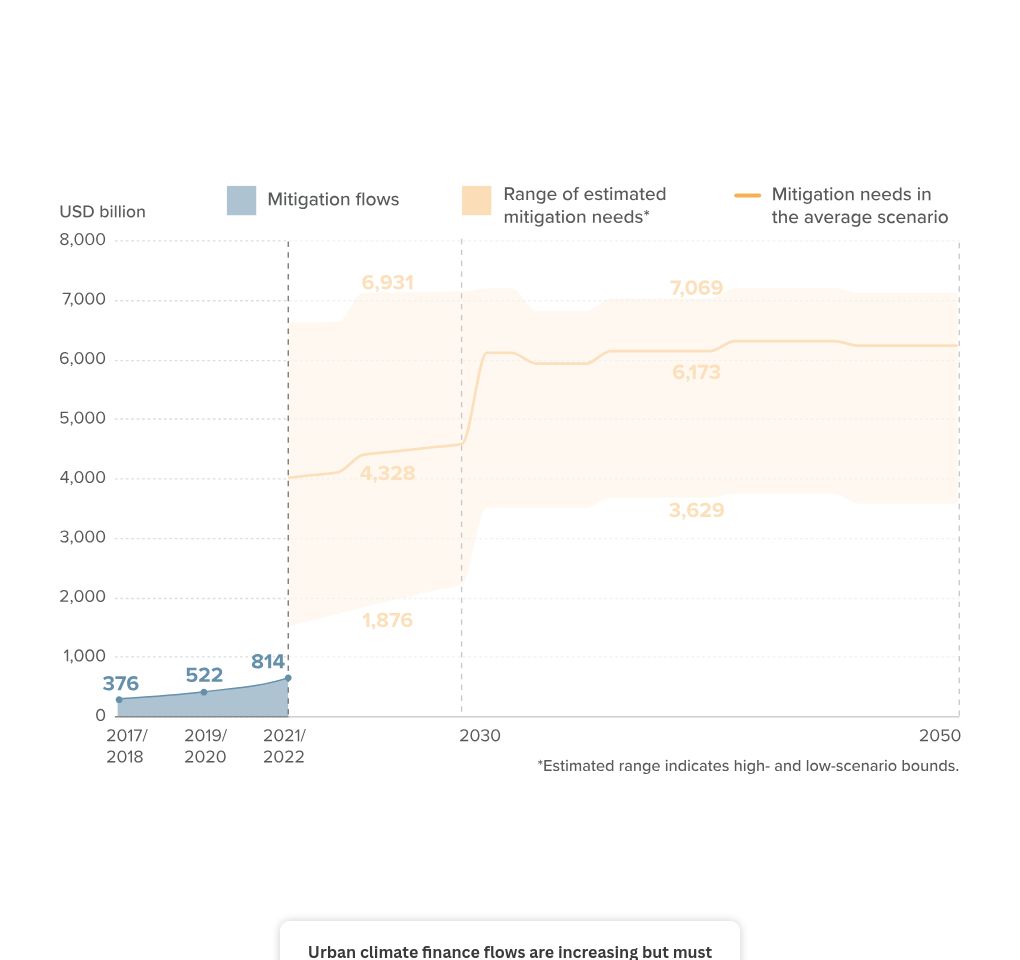

For mitigation alone, cities need an estimated USD 4.3 trillion annually from now until 2030, and more than USD 6 trillion annually from 2031 to 2050. This report provides the first comprehensive assessment of urban mitigation funding needs, broken down by sector and region. The underlying data gaps prevent a more comprehensive measurement of urban adaptation needs, although we provide preliminary estimates of some EMDEs.

Transport, energy and infrastructure dominate the investment needs of cities. By 2030, cities need annual investments of USD 1.7 trillion for transportation solutions (e.g. EVs and urban rail systems), USD 1.2 trillion for energy (mainly for electricity renewable and generating heat), and USD 1 trillion for buildings for replacement and new construction. . The regions with the highest needs to reduce urban costs by 2030 are East Asia and the Pacific (USD 1 trillion), Western Europe (USD 978 billion), and the US and Canada (USD 618 billion).

Adaptation requirements are more difficult to project. The 2024 SCCFR only estimates the adaptation needs for EMDE cities, which will require USD 147 billion per year until 2030, and USD 165 billion from then until 2050. These estimates are likely to be critical estimates due to significant uncertainties regarding climate impacts and risks, as well as limitations based on conditions, data and methods.

The high costs of climate inaction in cities around the world highlight the urgency of closing the adaptation finance gap. The economic impact of climate-related events is huge, with some cities already losing billions of dollars due to water shortages, flooding and damage to services.2

As the above points highlight, it is important for cities to obtain adequate funding to meet climate targets, adapt to the effects of climate change, and transition to a more sustainable economy. you are stable. Closing this gap will also open up huge investment opportunities, if key challenges can be overcome.

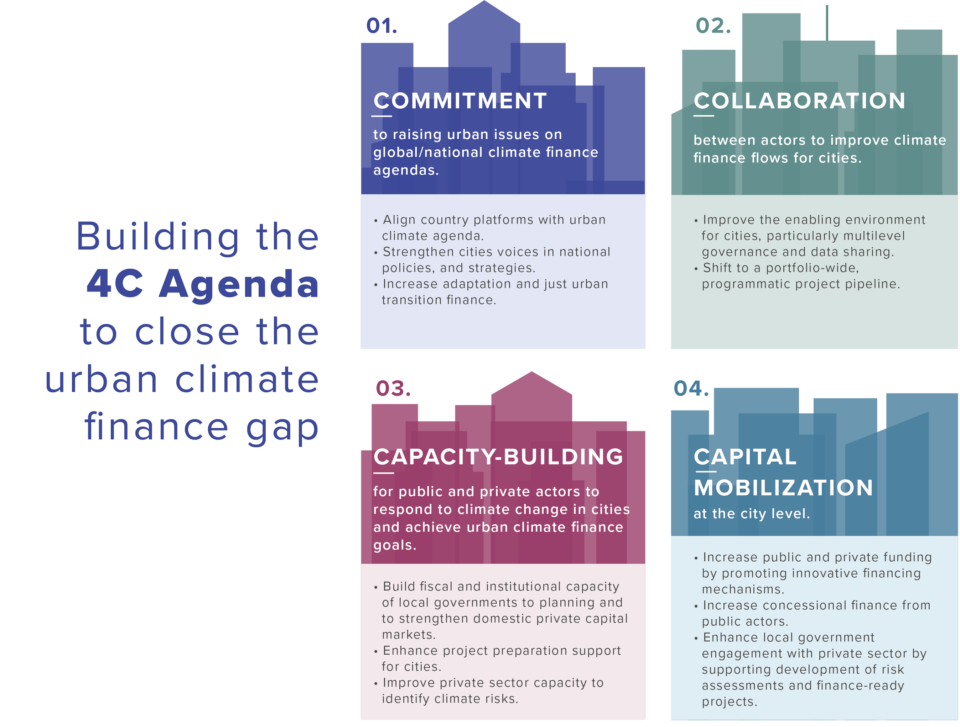

Building on our analysis, CCFLA makes a recommendation four key recommendations to increase urban climate finance:

- Improve the quantity and quality of urban climate finance. Urban climate finance must increase rapidly to meet urban needs. The quality of funding—how it is distributed among sectors, addresses existing inequalities, and strengthens enabling conditions—is also important. The limited public funding available must be used strategically to mobilize private investment to close these gaps. Urban climate action is often supported by traditional market instruments such as balance sheet equity and market debt funds. Although aid funding will remain limited, this can be used strategically to reduce risk and increase flow. Finally, addressing disparities between regions and within cities has the greatest potential to improve the effectiveness of urban climate finance as it scales up.

- Strengthening the country’s markets through the use of public finance policy. Urban climate action will require 1) strengthening local markets for cities to access public and private funding, 2) leveraging available public climate finance, and funding of accreditation, filling critical gaps and aligning private sector priorities with mainstream urban climate funding. and 3) strengthening the capacity of cities to access national markets by strengthening project preparation, capacity building and improving financial, financial and data management. Strong local markets can help eliminate chronic inequalities, especially by recognizing the role of households and individuals in climate finance.

- Fast adaptation costs, especially in EMDEs. The urgency of investing in urban adaptation cannot be overstated as adaptation finance flows are far from where they need to be. Increasing the adaptation process may require broadening the definition of tasks when defining and financing urban adaptation. A limited explanation of the financial risks of adaptation that falls short of broader capacity-building efforts. Cities urgently need to build energy efficiency for essential utilities, such as water and energy services. Metrics and common methods that can be widely adopted to track and report compliance costs will help increase coordination and alignment.

- Develop data and track the flow and needs of urban climate finance. There is a great need to improve the tracking and availability of urban climate finance data across all public and private sectors. The flow of urban adaptation and all estimates of urban needs are hampered by the lack of available data. In addition, inefficiencies and inconsistencies in reporting continue due to the lack of consistent taxation between actors. Tracking urban climate finance provides valuable information to support policy and investment decisions by national and international policy makers, as well as influential investors. These data are important for identifying the progress, gaps, and opportunities in the green transition of cities.

Addressing systemic barriers – such as insufficient commitment to urban climate action, weak enabling conditions, city-level gaps, and insufficient fundraising – and implementing recommendations The above four will require coordinated action across sectors, levels of government and actors.

Therefore, CCFLA proposes that all actors adopt the 4C Urban Climate Finance Program: Commitment, Cooperation, Capacity, and Capital Distribution.

With such coordinated, strategic initiatives, urban climate finance has the potential to grow rapidly.

The SCCFR 2024 reporting function builds on the SCCFR 2021 framework, ensuring comparability of data and methods to reveal urban climate over time. This data can be used to monitor, benchmark, and inform progress. The current report also makes improvements to the methodology for assessing urban climate finance and, for the first time, provides a clear estimate of what cities need to meet key climate targets.

#State #City #Climate #Finance #CPI